Explain the Different Instruments of Monetary Policy

The RBI has to control the supply of money in the market through a variation in lending or borrowing interest rates Let me explain the major tools which are used by RBI to implement its monetary policy. Monetary policy is dictated by central banks.

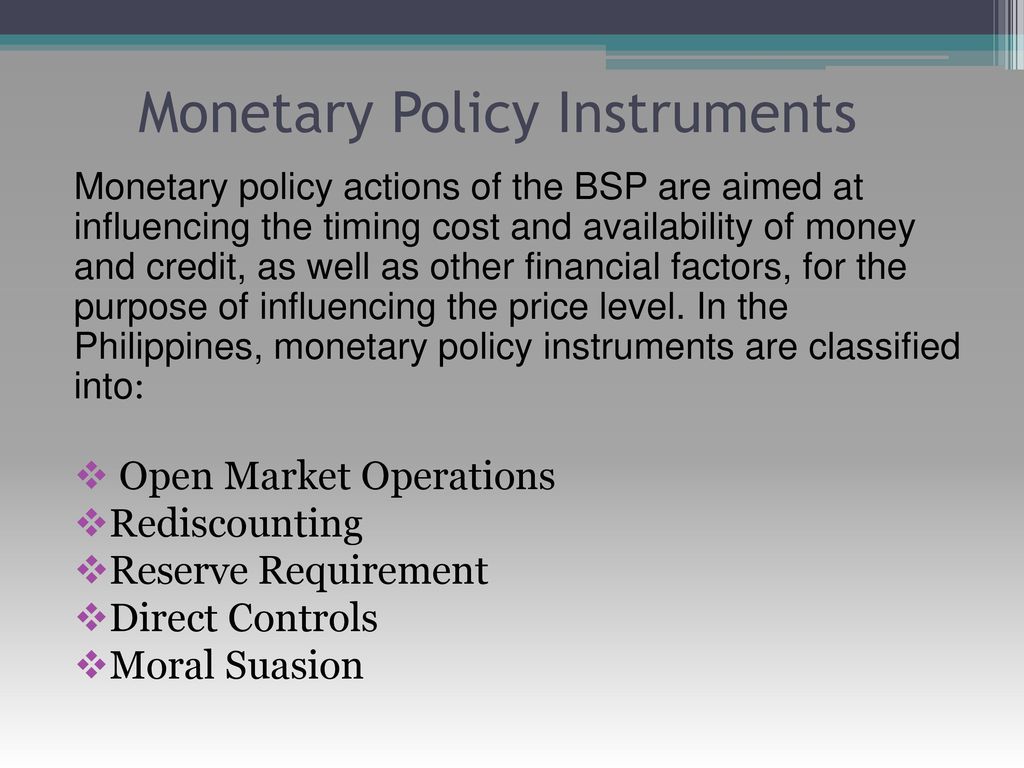

Bsp Control Instruments In Monetary Policy Ppt Download

By managing the money supply a central bank aims to influence.

. Monetary policy addresses interest rates and the supply of money in circulation and it is generally managed by a central bank. Monetary policy instruments The Reserve Management Directorate of the CBB offers a foreign exchange facility for buying and selling Bahraini dinars against US dollar at rates very close to the official exchange rate. The first tool of monetary policy is Open Market Operations which refer to the buying and selling of financial instruments by central banks.

Open market operations refer to sale and purchase of securities in the money market by the. The main three tools of monetary policy are open market operations reserve requirement and the discount rate. They are tools for economic management that brings about sustainable economic growth and development.

The central bank adopts contractionary monetary policies Contractionary Monetary Policies Contractionary monetary policy is the type of economic policy that is basically used to deal with inflation and it also involves minimizing the funds supply in order to bring an enhancement in the cost of borrowings which will ultimately lower the gross. The instruments of monetary policy are variation in the bank rate the repo rate and other interest rates open market operations OMOs selective credit controls and variations in reserve ratio VRR. Hello and Welcome to this New Video for RBI Monetary Policy Explain in - Hindi.

The Reserve Bank of India employs various instruments of monetary policy in India to achieve the objectives of price stability and higher economic growth. Monetary Policy of RBI Instruments. The Monetary Policy is a process whereby the monetary authority generally the central bank controls or regulate the money supply in the economy.

Monetary policy guides the Central Banks supply of money in order to achieve the objectives of price stability or low inflation rate full employment and growth in aggregate income. The expansionary policy uses the tools in the following way. One of the most effective instruments of monetary policy is the bank rate.

Monetary Policy UPSC Notes-Download PDF Here. What are the instruments of monetary policy. The Federal Reserves three instruments of monetary policy are open market operations the discount rate and reserve requirements.

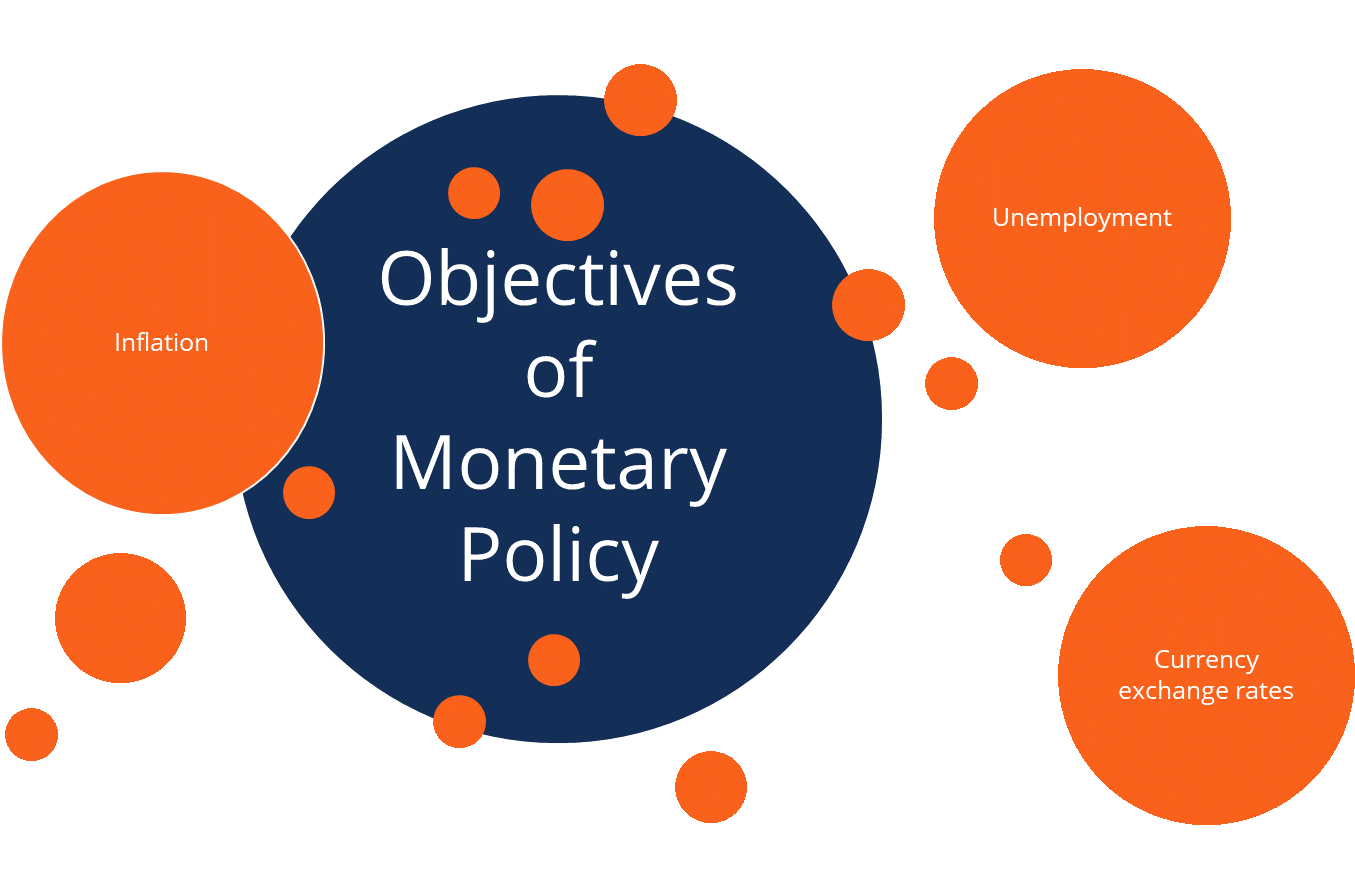

The three objectives of monetary policy are controlling inflation managing employment levels and maintaining long-term interest rates. In this Video you Will Learn about - Instruments of Monetary Polic. This is a monetary policy that aims to increase the money supply in the economy by decreasing interest rates purchasing government securities by central banks and lowering the reserve requirements for banks.

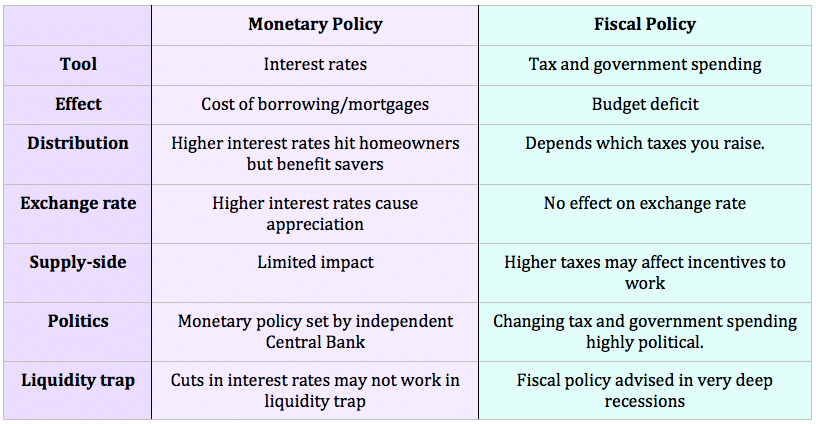

Fiscal policy addresses taxation and government spending and it is. An open market operation is an instrument which involves buyingselling of securities like government bond from or to the public and banks. Open Market Operations OMO Cash Reserve Ration CRR.

Some of the following instruments are used by RBI as a part of their monetary policies. This the Central Bank is able to do with the help of three instruments of monetary policy. The adjustments to short-term interest rates are the main monetary policy tool for a central bank.

Lower the short-term interest rates. Instruments of Monetary Policy. WHAT ARE THE INSTRUMENTS OF MONETARY POLICY.

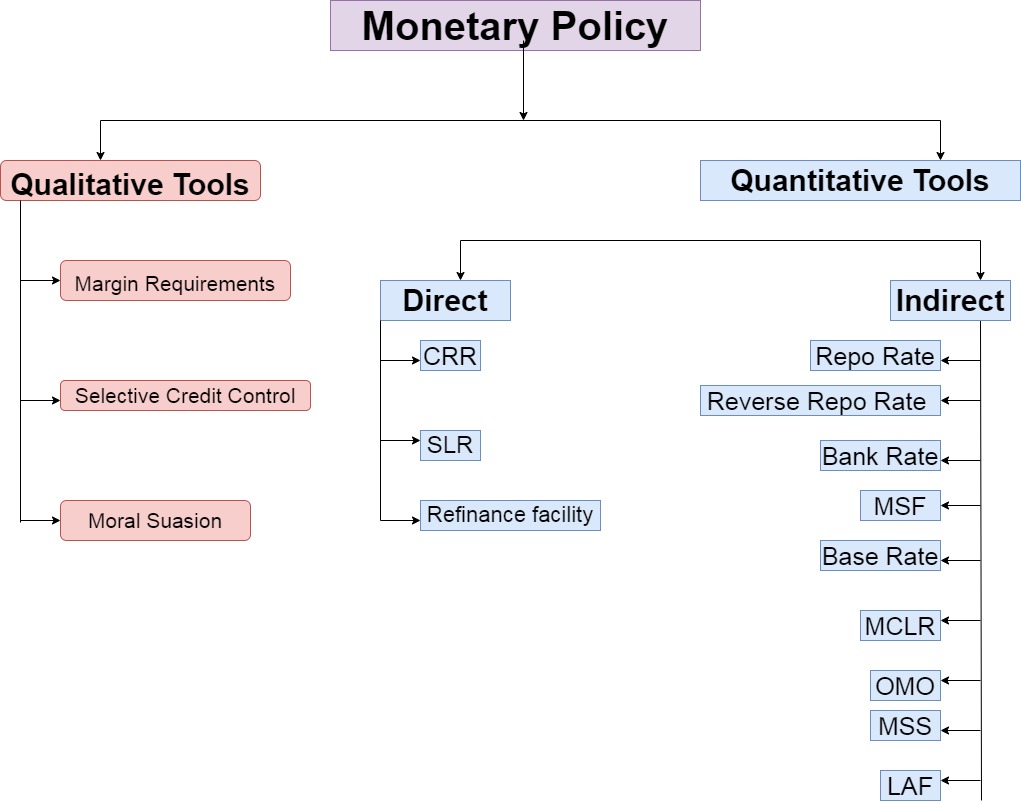

An expansionary policy lowers unemployment and stimulates business activities and consumer spending. The main instruments of the monetary policy are Cash Reserve Ratio Statutory Liquidity Ratio Bank Rate Repo Rate Reverse Repo Rate and Open Market Operations. The monetary policy tools are classified as direct and indirect or market based tools.

The monetary policy framework is geared to support the general economic goals of the Kingdom. Instruments of Monetary Policy in India. Instruments of Monetary Policy.

Monetary policy tools are techniques used by CBN to influence the prices of money in an economy. The bank rate is the minimum lending rate of the central bank at which it rediscounts first class. The overall goal of the.

Open market operations involve the buying and selling of government securities. The Fed implements monetary policy through open market operations reserve requirements discount rates the federal funds rate and inflation targeting. Some of the important instrument or tools of monetary policy in India are.

Changes in Reserve Ratios. The targets are to be changed by using the instruments to achieve the objectives. Open Market Operations is when the RBI involves itself directly and buys or sells short-term.

Lets understand the Quantitative and Qualitative instruments of RBIs monetary policy individually. Commercial banks can usually take out short-term loans from the central bank to meet their liquidity shortages. The central bank uses several instruments of monetary policy referred to as monetary variables at its discretion to regulate the credit availability and liquidity money supply in a.

And to control this RBI implements the monetary policys Quantitative and Qualitative instruments to achieve economic goals. Fiduciary or paper money is issued by the Central Bank on the basis of computation of estimated demand for cash. The Reserve Bank of India executes different mechanism and tools to meet its objectives.

Instruments of Monetary Policy 1 Open Market Operations. Monetary policy is the control of the quantity of money available in an economy and the channels by which new money is supplied. The main instruments of these policies are CRR SLR Bank Rate Repo Rate Reverse Repo Rate Open Market Operations etc.

Monetary Policy Of India Bba Mantra

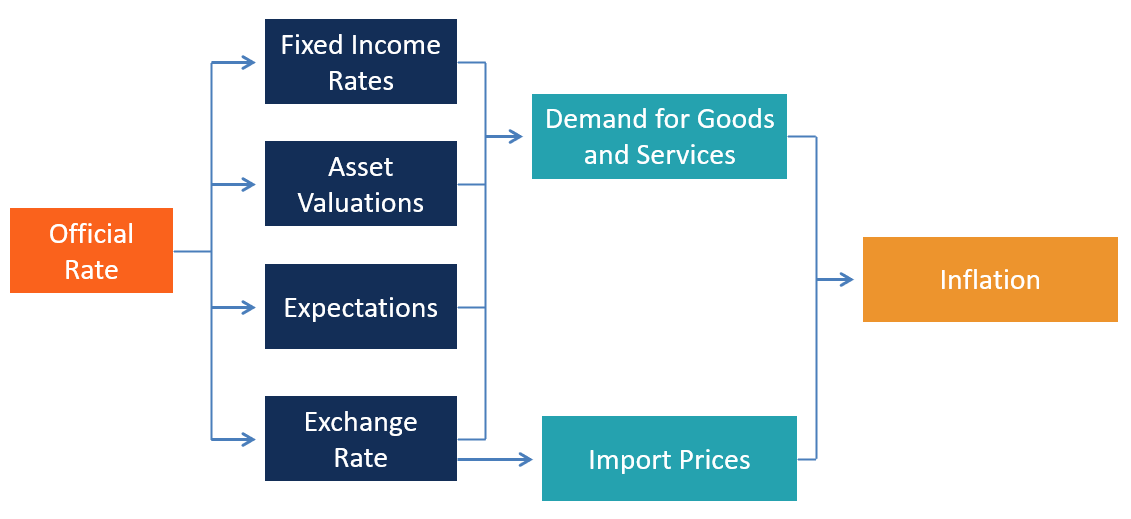

Monetary Transmission Mechanism Overview Central Bank Action

Uk Monetary Policy Economics Help

Monetary Policy Instruments Bank Of Jamaica

Monetary Policy Tools And Money Supply In India Civilsdaily

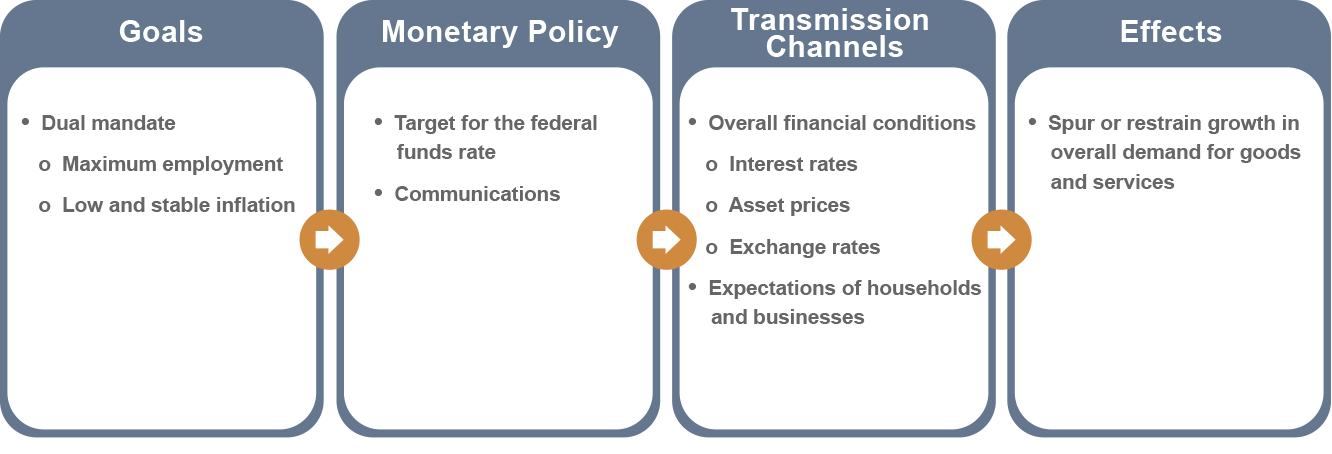

Federal Reserve Board Monetary Policy What Are Its Goals How Does It Work

What Are The Instruments Of Monetary Policy Business Jargons

5 Qualitative Measures Of Monetary Policy Econtips

Monetary Policy Of Rbi Objectives Instruments Process Thesisbusiness

What Are The Instruments Of Monetary Policy Of Rbi Economics Shaalaa Com

Monetary Policy Objectives Tools And Types Of Monetary Policies

Monetary Policy Vs Fiscal Policy Economics Help

Bsp Control Instruments In Monetary Policy Ppt Download

Economics Monetary Policy Explained With Examples Civilsdaily

Monetary Policy Instruments Targets And Goals Download Scientific Diagram

Comments

Post a Comment